Insurity Predict on AWS

Improve profitability and pricing segmentation with Insurity Predict’s market-leading predictive models.

In today’s competitive landscape, predictive power is an asset and a differentiator. Insurity Predict, powered by Valen, is the P&C industry’s most respected predictive analytics and modeling platform you can use, leveraging the predictive power of the proprietary $109B Valen Data Consortium. With Insurity Predict, you can gain a deeper understanding of your portfolio and underwriting decisions to grow your bottom line, proactively manage your business, and discover new market opportunities.

Insurity is an AWS Partner and has achieved the AWS Financial Services Competency. Competency Partners have industry expertise, solutions that align with AWS architectural best practices, and staff with AWS certifications.

Data Consortium

Add predictive power to your underwriting and pricing models with the industry’s most powerful data consortium

Calibrated Models

Mitigate risk with predictive models for pricing, risk selection, premium audit, payroll misclassification, and more

Rapid Deployment

Deploy production-ready models in as little as 4 weeks and calibrated models within 12-18 weeks

Seamless Integration

Streamline operations by plugging in predictive analytics into your workflows

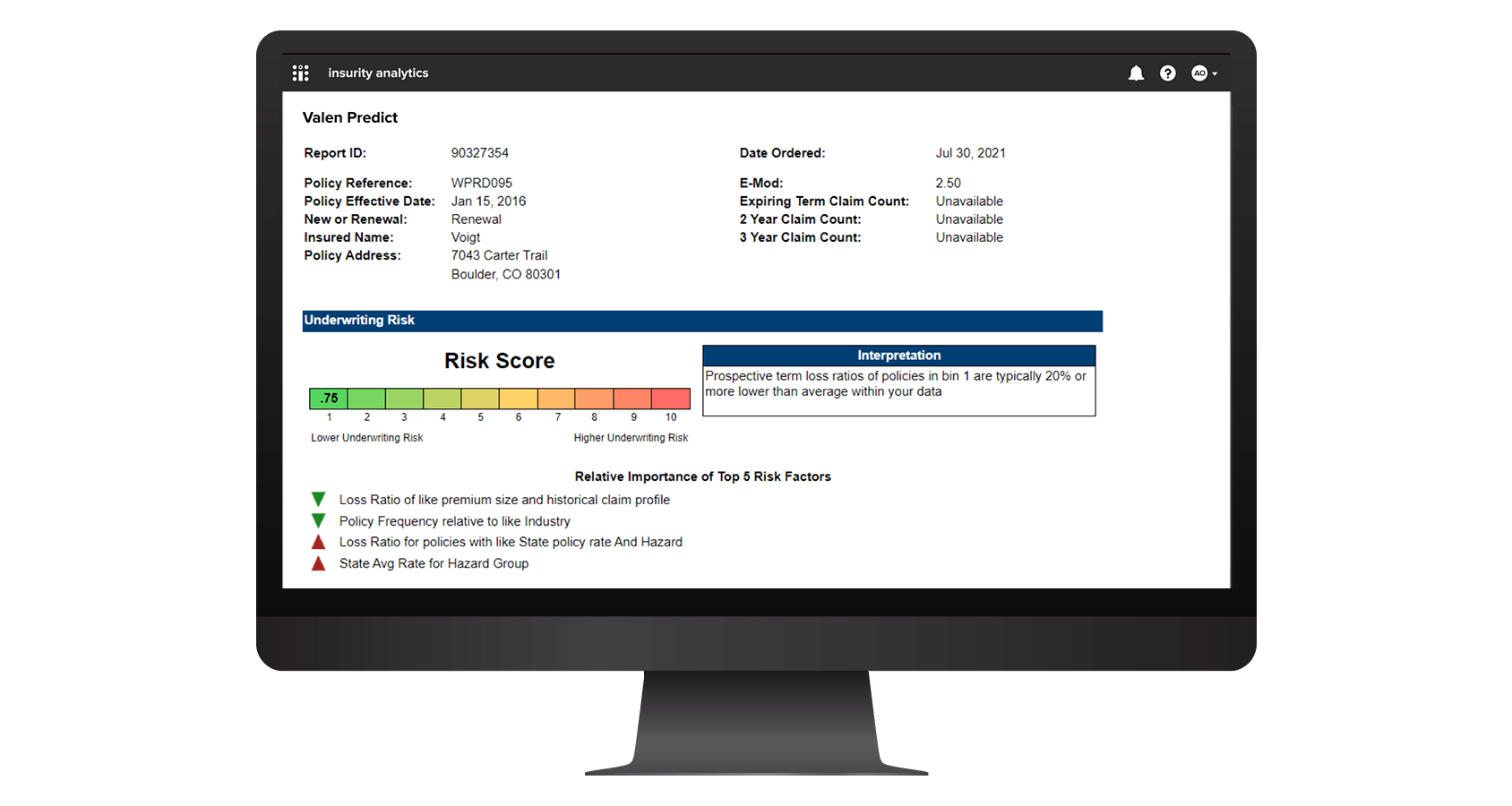

Get real-time predictive insights

Get real-time, data-driven insights when quoting or renewing business with calibrated predictive models from the Valen Data Consortium. Insurity Predict models use advanced AI and machine learning techniques to enable automation and provide superior decision support. Whatever your business goals may be, Insurity will generate a dataset and model to achieve your objectives with an average build and deployment time of only 12-18 weeks for calibrated models and 4-6 weeks for production-ready models.

Modernize your underwriting

Improve underwriting efficiency and accelerate growth with straight-through processing workflows that are custom designed to help achieve your business automation goals. Insurity’s predictive analytics solution delivers strategy, design, implementation, and measurement through a proven framework, enabling your underwriters to focus on policies that require their expertise. Put data to work as a decision engine while gaining a partner that will monitor the performance of your workflows in real time.

Proactive management

Know underwriting performance in advance and gain actionable insights to proactively manage your portfolio. Insurity’s proprietary underlying data model combines model predictions, actual underwriting decisions, and actual claims experience to show quantifiable results. Individual policy predictions are aggregated to show a portfolio view, leveraging predictions as leading performance indicators allow you to proactively optimize profitable segments and address problem areas in real time.

Expand your predictive power

Add unparalleled depth and breadth to your data while extending your predictive power with the Valen Data Consortium. Boasting $109 billion in premium across all standard P&C lines of business, it’s the largest proprietary database of policy, claims, billing, and submission data available. Insurity Predict enables you to increase model lift with predictive variables from the Valen Data Consortium and is built on robust, credible, and anonymized datasets to deliver superior ROI.