Insurity for MGAs

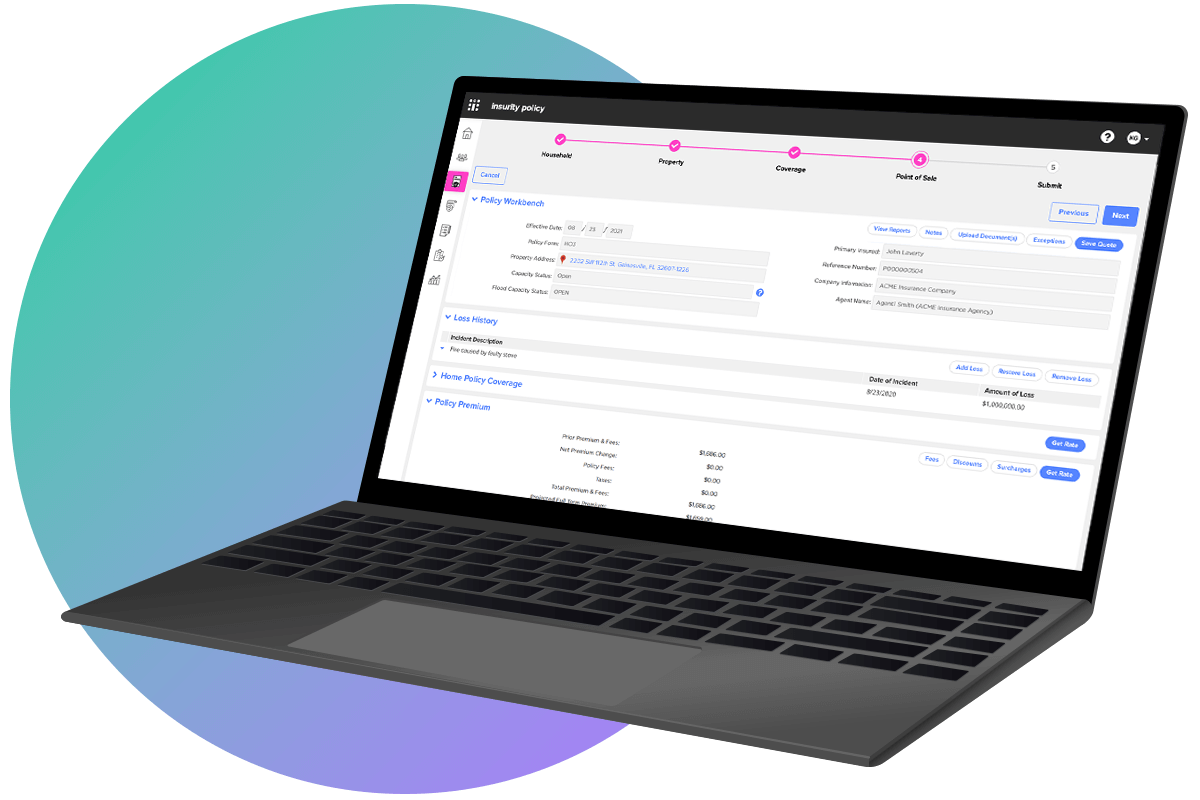

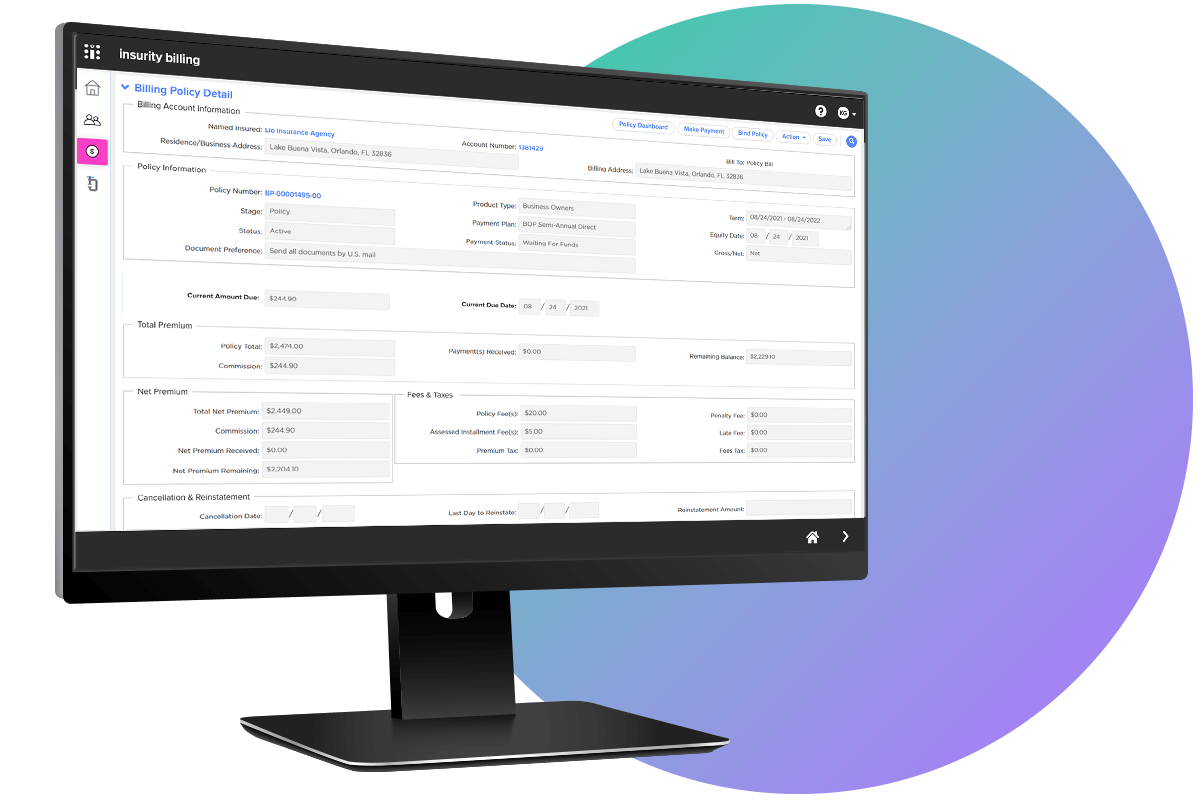

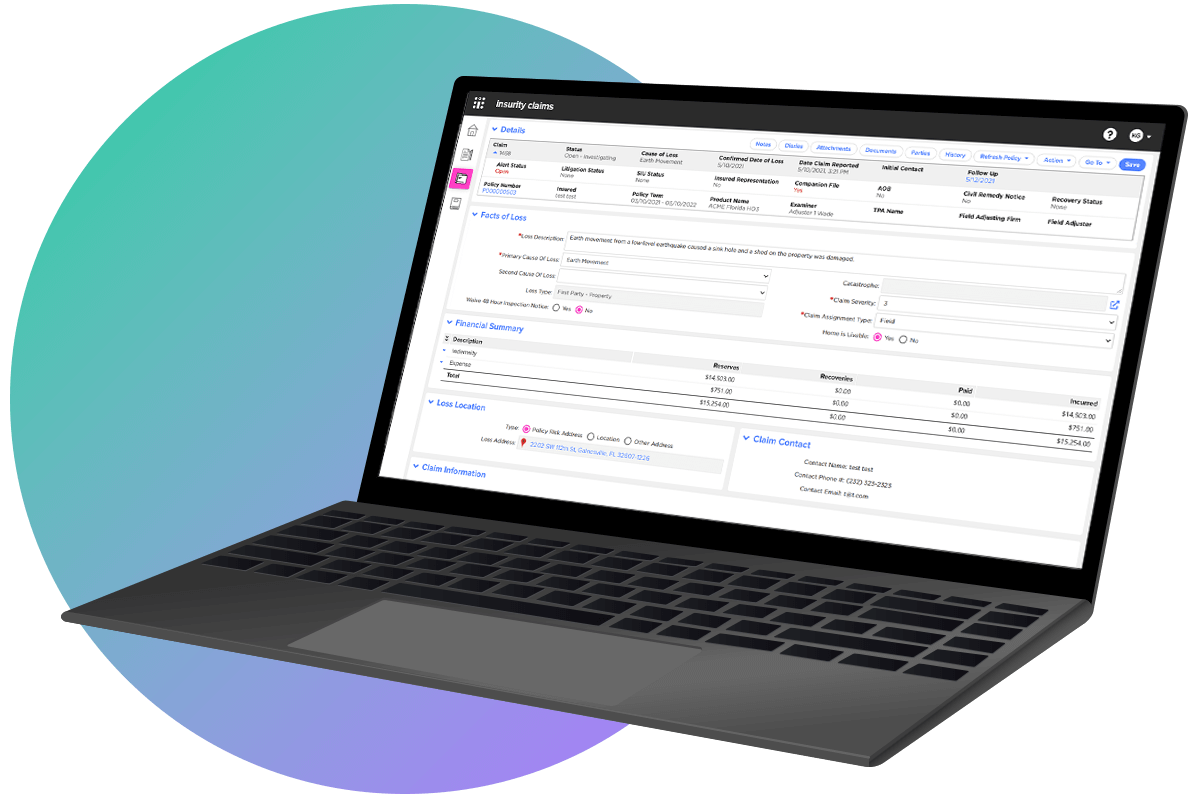

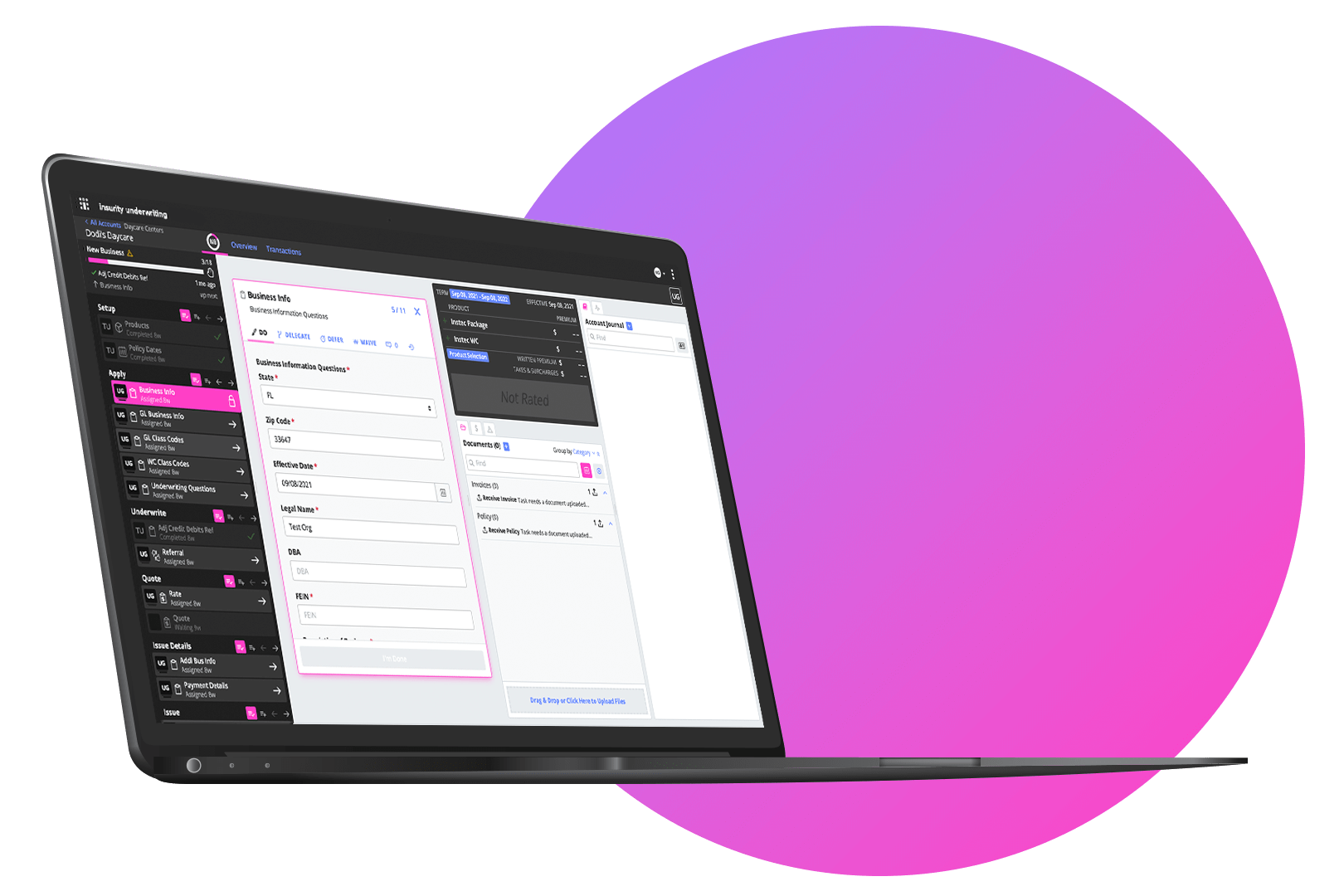

Insurity empowers MGAs, MGUs, and program managers to simplify operations on a single, purpose-built platform. With Insurity, intermediaries can make better, faster underwriting decisions and support automated risk placement across carriers, producers, and policyholders.

Win Business More Quickly

Get faster, more accurate quotes and transactions with digital trading

Avoid Adverse Risk Selection

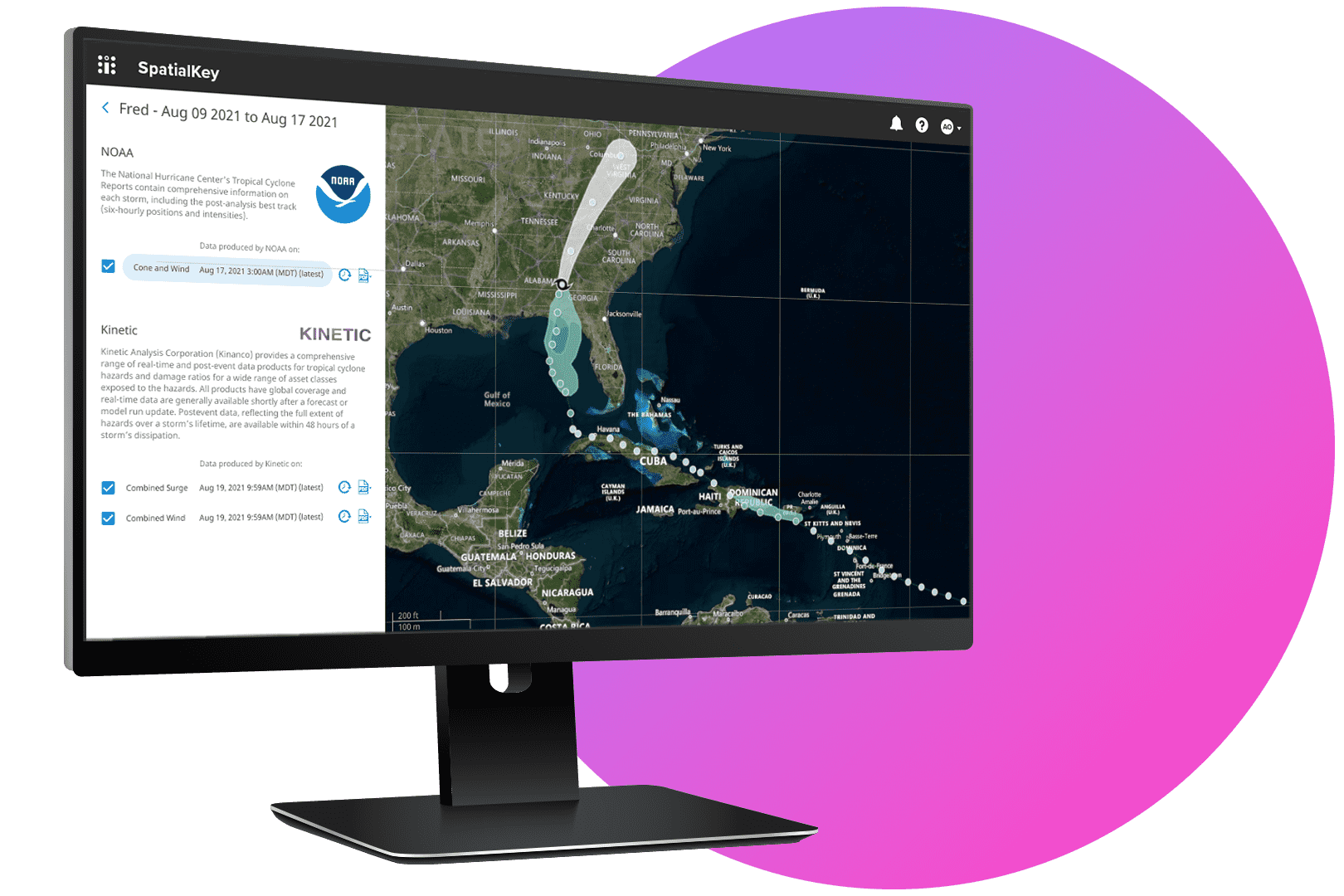

Make better underwriting decisions and understand risk with geospatial analytics

Improve Carrier Partnerships

Strengthen relationships with a trading platform that encourages interactions

Becoming more efficient with Insurity’s MGA solutions

Learn how Cable Holdings Company leverages Insurity’s MGA solutions to maintain their high service standards, increase operational efficiency, and achieve faster growth.

Our success stories

Georgia Stern Insurance Agency Goes Live on Insurity's MGA Solutions to Dramatically Increase Efficiency and Billing Performance

Insurity’s cloud-based MGA platform and flexible billing solution enables Georgia Stern Insurance Agency to increase operational efficiency and reduce overall billing costs.

Datos Insights Recognizes Insurity as a Dominant Provider of MGA Solutions

Trusted by 7 of the top 10 U.S. MGAs, Insurity’s MGA software was recognized in Datos Insights’ latest report on Property & Casualty MGA Core Systems.

Power your MGA on the Insurity Platform

Book a Demo