Insurity for Personal Lines

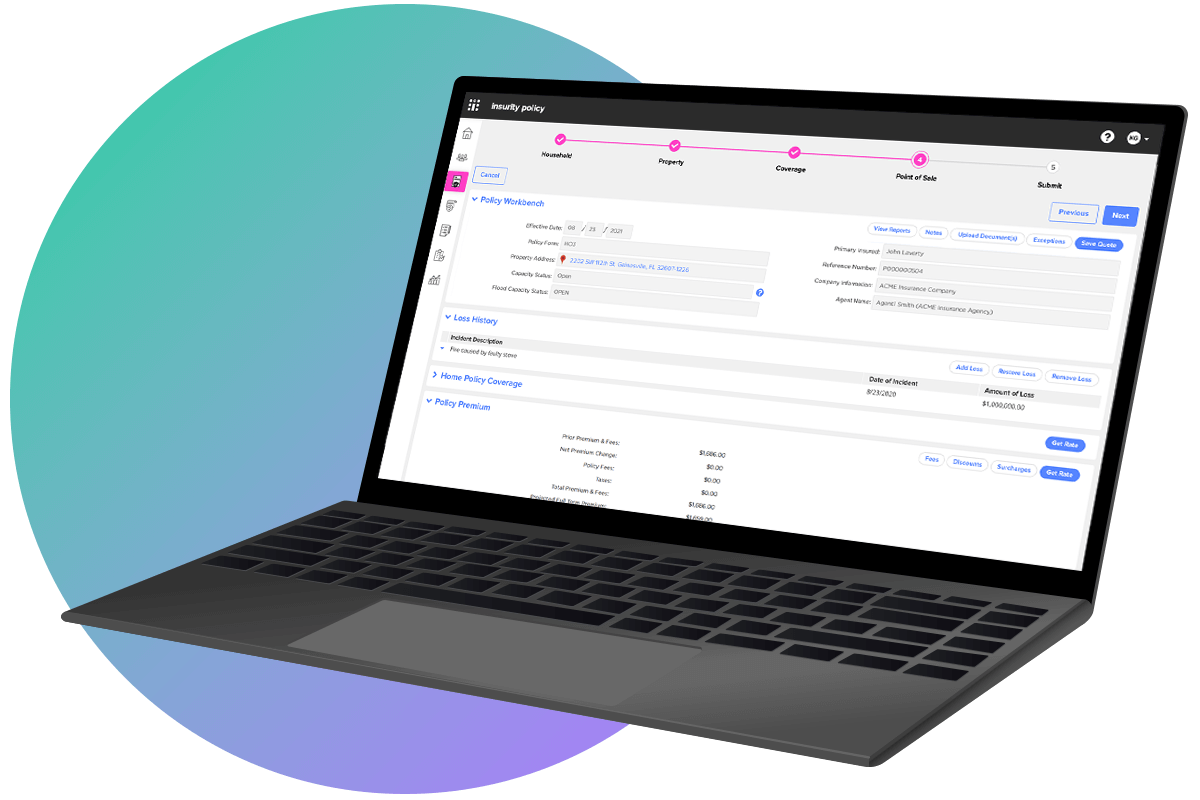

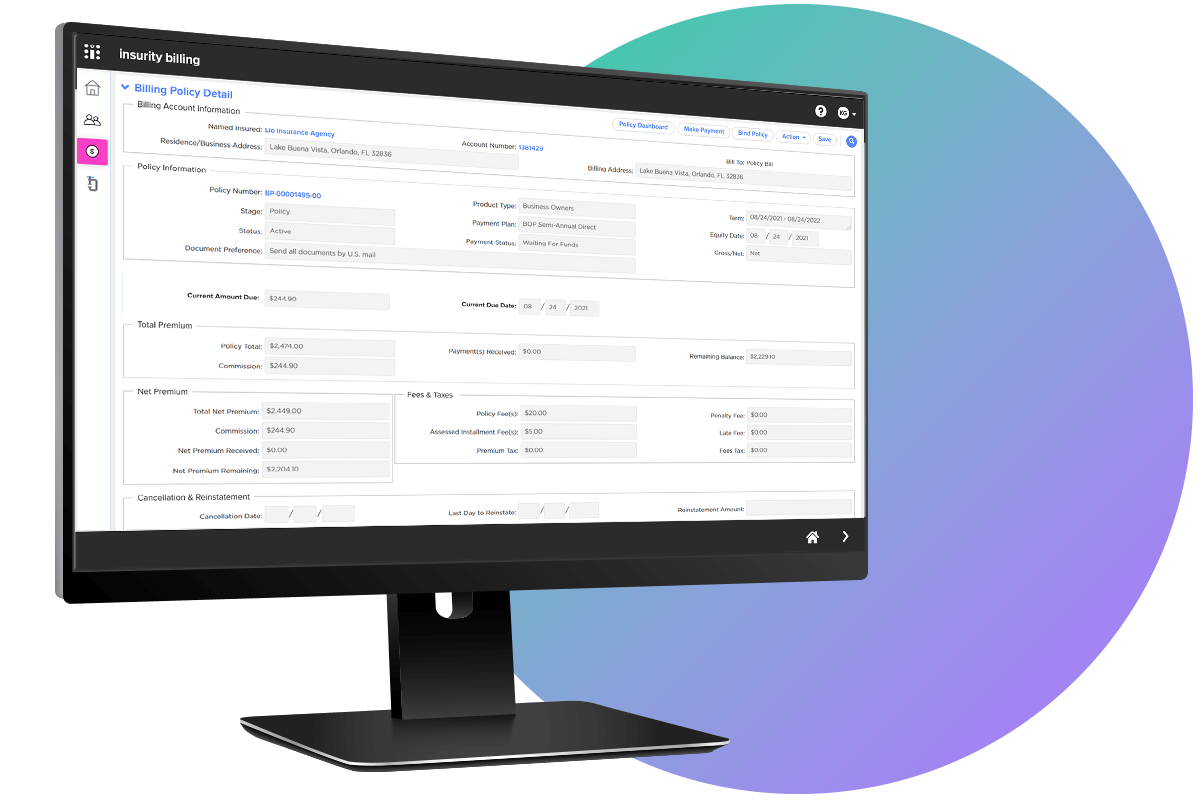

Insurity empowers personal lines carriers to operate more efficiently on a cost-effective, highly configurable, and cloud-native multiline platform. With Insurity’s no-code toolset, insurers can rapidly implement new lines of business or develop products for new markets from concept to product in days, not months.

Enhance Risk Assessment

Leverage integrated third-party data and advanced analytics to improve risk selection and underwriting accuracy

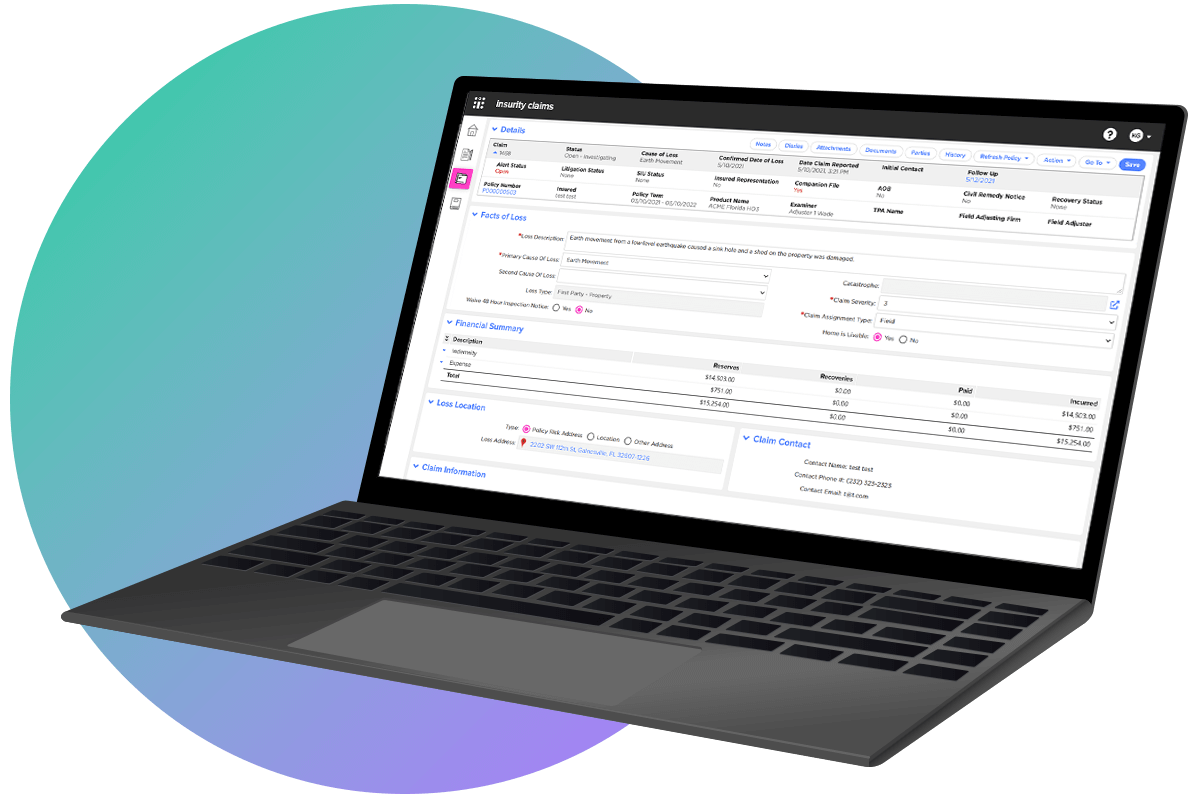

Process Claims Faster

Use automated workflow and AI-driven tools to expedite claims processing, enhancing customer satisfaction during critical times

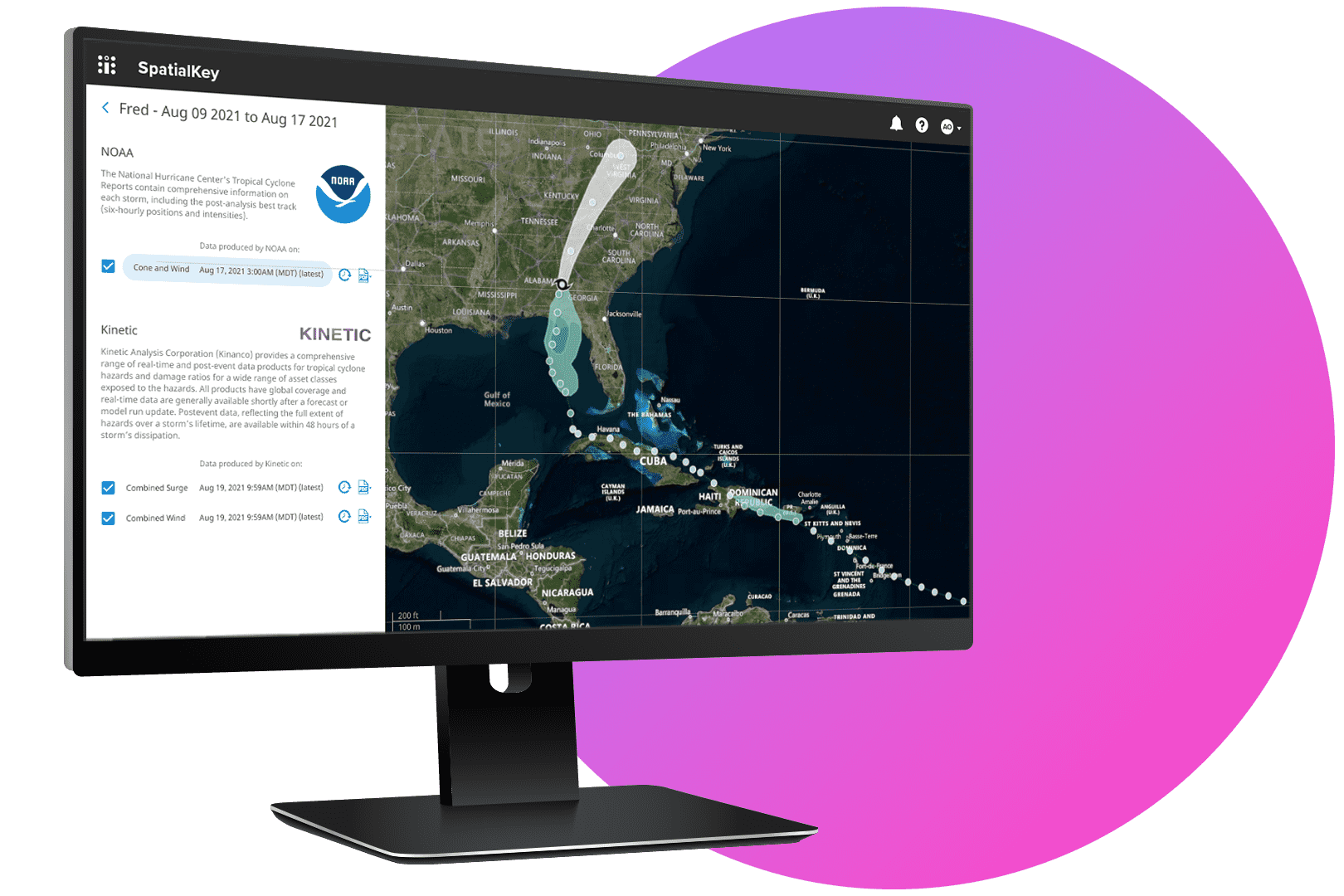

Manage Risk Portfolio

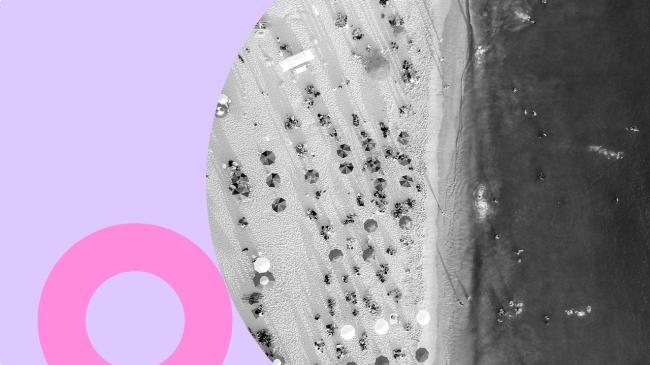

Evaluate risk aggregation and respond immediately to catastrophic events using the most modern geospatial tools in the industry

How does SpatialKey allow a more proactive response to severe weather?

As severe weather becomes more frequent, SpatialKey enables personal lines insurers like Markel to gain immediate insights and optimize their portfolios for maximum profitability.

Our success stories

Insurity positioned as a Leader in the Everest Group PEAK Matrix® Assessment

Learn why Insurity’s cloud-based solution for personal lines carriers was recognized for enabling insurers to stay agile and flexible in a changing market.

Insurity for Personal Lines Solution Overview

Improve speed to market, customer satisfaction, and efficiency on Insurity’s scalable, configurable, cloud-hosted platform for personal lines.

How to Better Understand Coastal Risk with SpatialKey

Learn how SpatialKey can empower your catastrophe risk professionals to make analytically-driven decisions to smartly manage coastal risk for properties.

Power your personal lines on the Insurity Platform

Book a Demo