Insurity Underwriting

Enable underwriters to focus on the most profitable submissions with AI-driven risk scoring

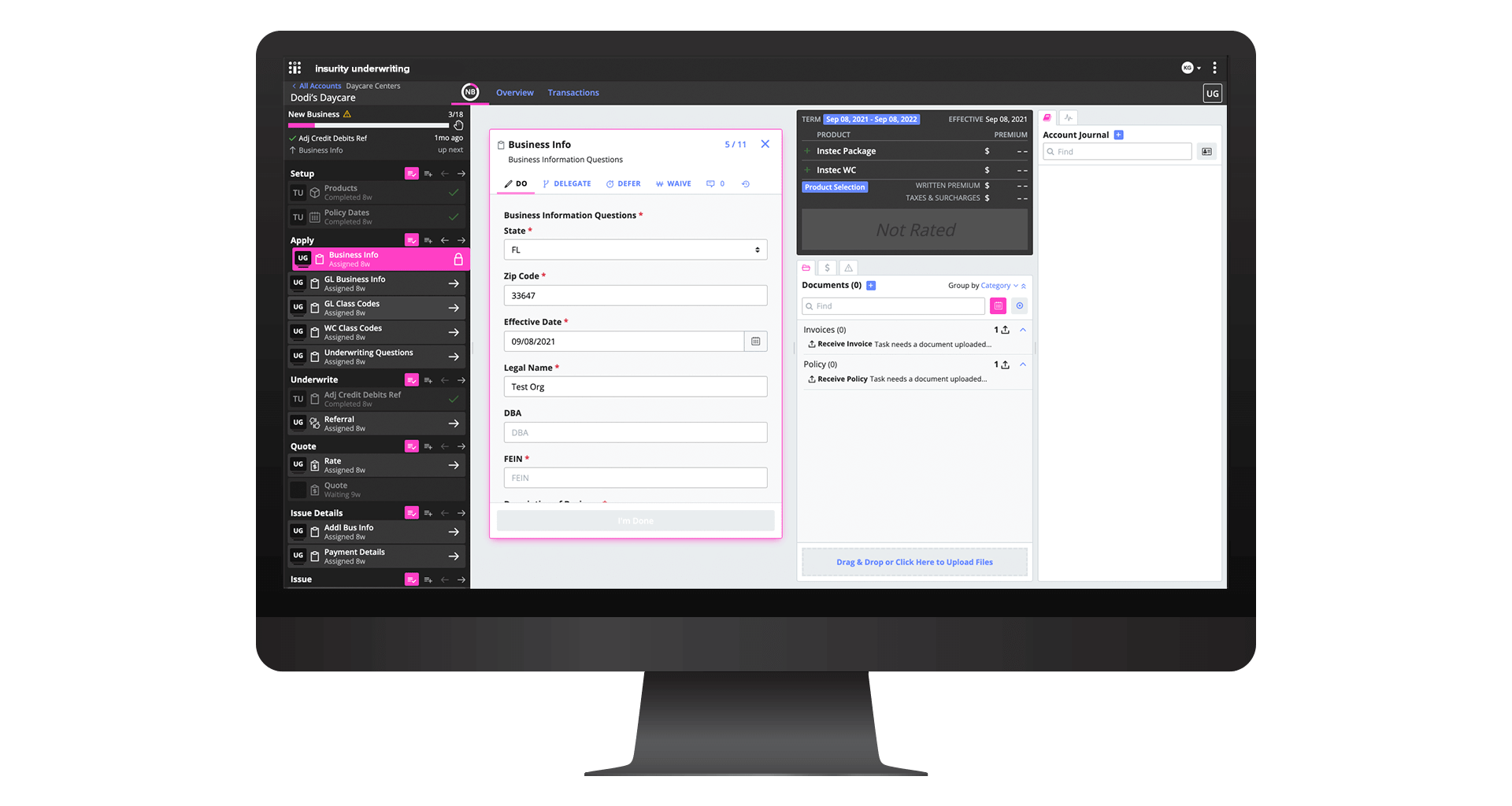

Analyze and process submissions faster than ever with AI-powered software purpose-built for underwriters. Insurity Underwriting provides a highly-configurable rules engine, integrations with critical data sources, and AI-driven workflow tools to streamline the underwriting process in one cloud-native platform.

Quick Configuration

Update workflows, rules, data, teams and more with low-code tools to meet your evolving needs and improve your processes over time.

Easy Connectivity

Rapidly create API keys and webhooks and use a built-in platform to set up connections and move data to and from sources and applications.

AI-Powered Platform

Transform how you underwrite risk with an AI-powered risk scoring assistant that shows the profitability of complex risks instantly.

Robust Analytics

Analyze operational efficiency and gain a holistic understanding of your book performance with built-in dashboards and reporting.

Why Insurity Underwriting?

Improve decision making

Equip your underwriters with AI-powered tools for smarter decision-making. Leverage dynamic risk triage, automated data extraction, and seamless integrations to deliver an account-level view of risk across multiple insurance products.

Reduce expense ratios

Automate routine underwriting decisions with a configurable rules engine that automatically processes or auto-declines straightforward risks. Minimize time spent sifting through data sources and switching between systems by bringing all data together for efficient processing.

Foster collaboration

Drive efficiency with collaborative workflows that give underwriting teams visibility at every step of the process. Eliminate the need for back-and-forth communication with rules-triggered email and text message reminders, so information flows friction-free for faster turnaround and responsiveness.

Integrate systems easily

Collect information into a single platform, regardless of where your data comes from. Easy-to-use APIs enable you to import data from any policy admin system, third-party provider, scoring engine, or other system. Event-based webhooks automatically notify systems when new data is needed.

Resources

Insurity Recognized by IDC MarketScape for Intelligent Underwriting Workbench Applications

Insurity Underwriting and Business Intelligence solutions recognized for delivering innovative and cloud-native solutions to the P&C insurance market.

PLM Insurance Company Goes Live with Insurity Underwriting

Insurity’s cloud-native, configurable underwriting solution enables Pennsylvania Lumbermens Mutual Insurance Company to automate core processes for more streamlined underwriting.

Insurity Underwriting Solution Overview

Empower underwriters to focus on risk assessment, not routine tasks, with Insurity Underwriting.

Book a demo